Streamline your Materials

Inventory &

Purchasing

Begin and end your distillery processes with innovative inventory management solutions.

OnBatch provides the tools you need to effectively trace materials through to finished goods, set conditional pricing, and declutter your BOM for a smooth production process.

Learn More About:

The Backbone of your Brand

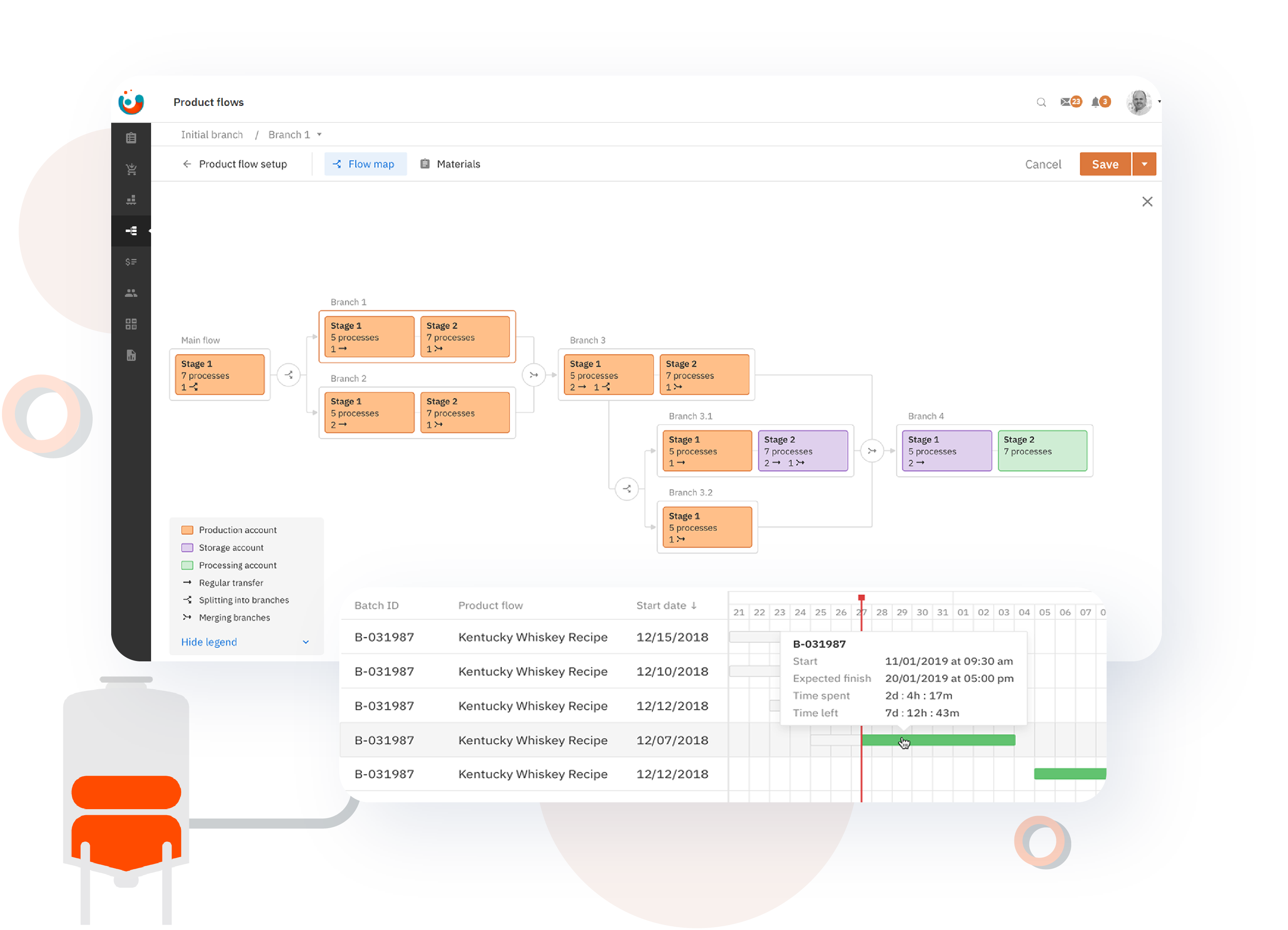

Manufacturing

Let creativity drive you to innovation with our unique manufacturing tools. Product flows provide distillers with custom, repeatable, and scalable processes and are completely unique to OnBatch. No matter your production size we have the tools needed to craft amazing spirits.

Customize Your World

Warehousing

Spend less time searching for items with our unique warehousing tools. Build a visual layout of your warehouse space with the visual builder, giving you a simplified way to track and trace your incoming and outgoing inventory.

Fulfill the Demand

Sales & CRM

Identify new growth opportunities for your distillery with sales insights, invoicing, and costing tools. For an all-in-one experience, integrate your Quickbooks or Xero accounts with the OnBatch platform.

Data Anywhere Anytime

Reporting

Take advantage of our exclusive Pay.gov integration coupled with automated TTB reporting and excise tax reporting for stress-free compliance management. With all that extra time you can set and track your KPIs and business growth goals using the OnBatch business reports and dashboards.

Request a Product Demonstration

Our Clients